Search This Blog

An independent writer with main goal "Happy Investing". Disclaimer: This Blog/writer is not a research analyst & expressing opinion only as an individual investor in Indian equities. Investors are advised to consult financial consultant before acting on any such information. He is not responsible for any loss arising out of any information, post or opinion appearing on this blog. This is for personal study, all information posted on blog is as available in public domain.

Posts

Showing posts from January, 2017

Open Interest Analysis Workbook by Research Wings

- Get link

- X

- Other Apps

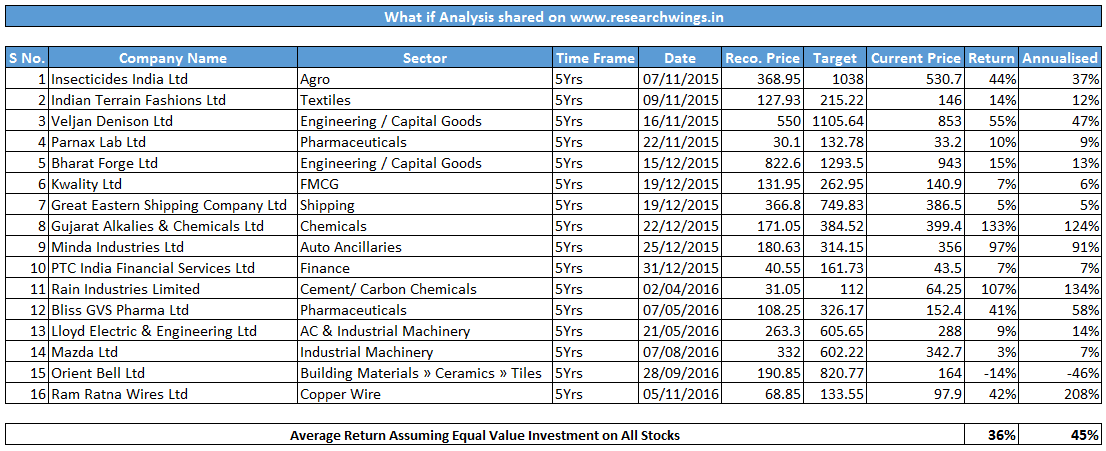

Performance - Research Wings - Fundamental Analysis

- Get link

- X

- Other Apps